Harmonized Code For Aircraft Parts - Learn about the Harmonized System Code (HS code), how to find the correct code for a product, its importance, the consequences of correct use and incorrect use.

If you import or export, you are familiar with the Harmonized System of Trade Descriptions and Codes, better known as the Harmonized System (HS) or the Harmonized System of Naming (HSN). It is a widely accepted method of business inventory management. Its main function is to help customs officials to identify products and determine the correct duties and taxes that will be imposed on them. In the Harmonized System, each product is assigned a unique numerical code called the HS code. This code consists of at least six digits and is usually a 10-digit number (although China has a 13-digit code). When exporting or importing, the HS code for your product must be included in your shipping documents, such as your commercial invoice, shipping list and shipping bill. As an exporter or importer, it is your legal responsibility to correctly identify the HS code of your product. Improper design can cause problems that you would be better off avoiding.

Harmonized Code For Aircraft Parts

Given the importance of the Harmonized System and its appropriate application in international trade, this report contains all the relevant information you need, including:

Federal Register :: Publication Of A Report On The Effect Of Imports Of Aluminum On The National Security: An Investigation Conducted Under Section 232 Of The Trade Expansion Act Of 1962, As Amended

The Harmonized System addresses the complexity and cost of using different product classification systems in different countries. According to reports, a product can be divided as many as 17 times in one transaction before it is done. The Harmonized System entered into force on January 1, 1988. It is administered and updated every five years by the World Organization of the Harmonized System (WCO). This system is used by more than 200 countries and economies covering more than 98% of products and international trade.

The Harmonized System includes more than 5,000 products. These are divided into ninety-seven and twenty-one chapters. Each chapter is divided into headings and, where appropriate, subheadings. Usually, products are listed in chronological order—plants first, finished products, semi-finished products, and finally finished products. So Chapter 1 is "Live Animals", Chapter 41 is "Skins and hides (other than fur) and skins" and Chapter 64 is "Shoes".

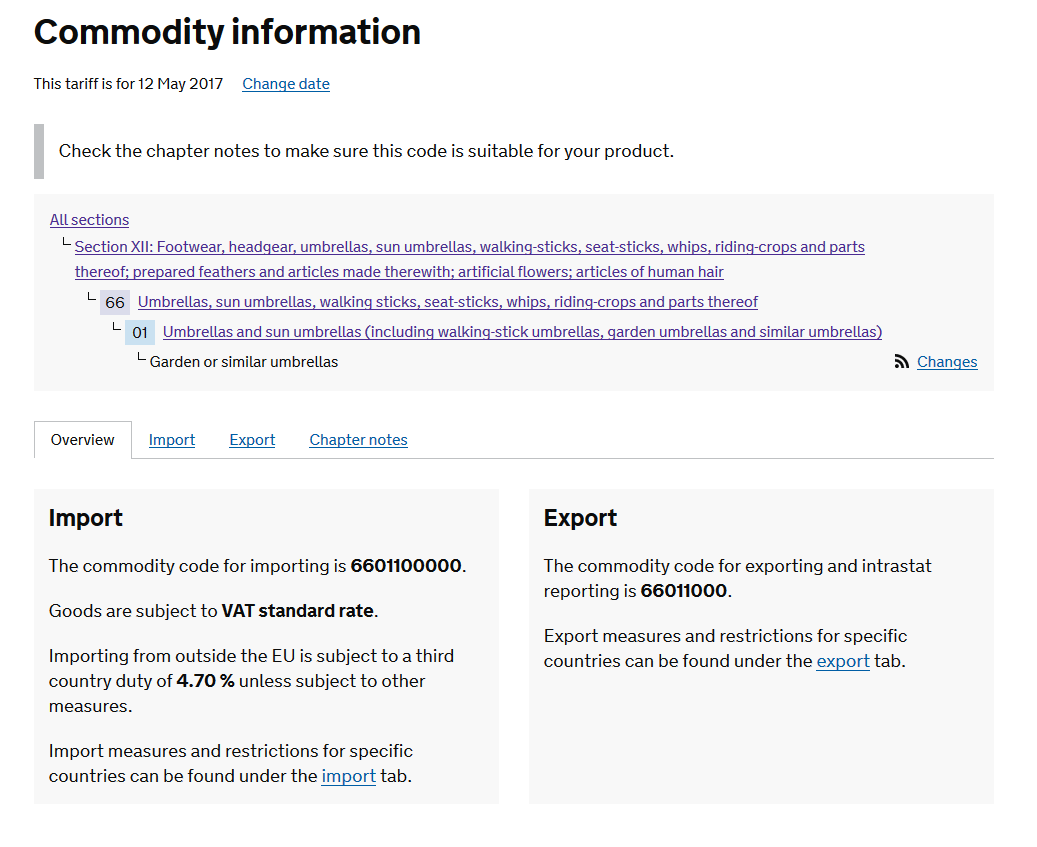

In the Harmonized System, each product is identified by a six-digit code, which is organized legally and logically according to specific rules. The six digits of the HS code can be divided into three parts:

1. General Rules of Harmonized System Interpretation: These rules ensure that a given product is linked to one subject (and key) and not to any other subject. There are six GRI guidelines, which are levels of GRI 1 that take precedence over GRI 2, and so on.

Aerospace Hs Code Definition

2. Notes on points, points and main points: Some points, points and main points of HS are listed. These notes help define specific sections and chapters by defining their scope and scope. According to the GRI, these statements are legally binding, so they are also called "Statutory Statements".

The main function of the Harmonized System is to serve as a basis for global tariffs. But it also has other uses, such as:

As mentioned earlier, the HS code can be more than six digits specified by the WCO. This is because countries are allowed to add more numbers to the first six digit code for further classification. These added numbers often differ from country to country.

The United States uses a 10-digit code, the first six of which are HS codes issued by the WCO. The US code is known as the Schedule B number for exports and the HTS code for imports.

How To Find The Right Hs Or Hts Code

Similarly, in India, imports and exports are assigned an eight-digit code known as ITC (HS) Code, where ITC stands for Indian Trade Classification and/or Indian Tariff Code. The system consists of two phases - Import Phase I and Export Phase II. There are 21 sections and 98 points in the attached table. The chapters are further divided into main and sub-topics. Phase II consists of 97 chapters. The ITC Code (HS) is created, maintained and updated by the Directorate General of Foreign Trade (DGFT).

The ITC (HS) code consists of the six-digit HS code plus the two-digit country "Tariff Item Code". For example, if the ITC (HS) code is 09011111, then

HS codes are used by governments, customs officials, statistical offices, regulators and consumers. As an importer/exporter, you are legally required to properly label your goods and enter the correct HS code on your shipping documents.

Using the wrong HS code means you will pay a higher or lower tariff. Once diagnosed, this can lead to:

Asean Harmonized Tariff Nomenclature (ahtn)

From April 1, the Indian government has made it mandatory for those who have a turnover of Rs 5 crore and above to sell taxable goods and services in India to pay the Goods and Services Tax (GST). The first requirement is a four-digit code. Similarly, taxpayers with a turnover of up to Rs 5 crore must enter a four-digit HS code on B2B (business-to-business) invoices. The first requirement is a binary code. So far, many GST taxpayers have voluntarily entered the six-digit HS code on their invoices and GST returns. According to the report, the aim of the move is to enable taxpayers to provide the correct HS code so that the tax authorities can "catch tax evasion and false invoices and incorrect tax claims".

Parts for aircraft, harmonized code list for export, harmonized code for laptop, harmonized code for clothing, harmonized code for computer, aircraft parts for sale, harmonized code for documents, harmonized tariff code for documents, harmonized code for export, harmonized code for electronics, harmonized code for stickers, harmonized code for fedex

0 Comments